Trs retirement calculator

Vested Tier 6 members with an inactive membership. Retirement may also occur at age 55 with less than five years of NYS service if two years of NYS service are rendered after their current membership date and since they reached age 53.

Ny Teacher Pension Calculations Made Simple The Legend Group

If you are a PERS participant your employer will contribute an additional 5 of your gross eligible compensation to your retirement account.

. Many systems allow employees age 65 to retire regardless of their years of service. The Overview of TRS and ORP click on above link to download PDF provides general information to help you choose the retirement plan that best suits your situation. 2022 Federal Income Tax Withholding Rates Information for TRS Retirees.

Tier I - First entered TRS on or before July 1 1990 Early retirement age 50 if vested and normal -. The Retirement System retains no record of estimates produced by this calculator. Get started with a calculator below plus receive additional news and resources when you sign up for our newsletter.

For TRS Plan 3 this is when you reach age 65. Age eligibility requirements are as follows. The TRS pension calculator is an educational tool designed to help members who are more than 5 years from retirement estimate their monthly benefit for service retirement.

1 2011 or have pre-existing creditable service with a reciprocal pension system prior to Jan. Five is the minimum but you can earn an unlimited number of years to increase your pension amount. TRS offers members a Tax-Deferred Annuity Program to supplement their benefits under the Qualified Pension Plan.

Private School Service Credit If you previously worked in a recognized private school you may be eligible to purchase up to 2 years of service credit. Your Human Resources Office will provide specific information for your institutions plan including a list of authorized ORP companies local employer contribution rate ORP. At this time we are working to improve the calculator and hope that it will be available soon.

The total employee and employer contribution is 13 of your gross eligible. Learn how we can help you. With TRS Plan 2 you need five years of service to qualify for a retirement.

What if you want to retire younger than age 65 and you dont have 30 years of service. Nor is there any guarantee that the estimate calculated will be received by the user. Tier 1 members in Teachers Retirement System of the State of Illinois first contributed to TRS before Jan.

ERS and TRS Retirement Calculator Registered MOS Users - The online calculator built within the MOS system is a great tool. You may use this calculator far in advance of your retirement to help you develop your personal retirement strategy by experimenting with various retirement scenarios. TRS Retirement Eligibility.

Step 2 Basic Information Retirement Date If you are running a service or disability retirement estimate you. If you have 30 or more years of service and you are age 62 you can also retire with a full benefit. Full retirement is the earliest age you can retire without any reduction to your retirement benefit.

Each pay period 8 of your gross eligible compensation is contributed to your retirement account through payroll deductions before it is taxed. MassMutual offers life insurance and protection products retirement and investment services to help you meet your financial goals. Full retirement is the earliest age you can retire without any reduction to your retirement.

Tier 2-6 members in active service may retire at age 55 with five years of New York State service credit. There are two mandatory retirement program options the Teacher Retirement System of Texas TRS and the Optional Retirement Program ORP. Use the WEP Online Calculator to calculate your estimated retirement or disability benefits.

If you are eligible for Social Security benefits on your spouses record and a pension not covered by Social Security the Government Pension Offset or GPO may affect your benefits. You meet eligibility requirements for retirement under the TRS DB plan either by age or by service. Since 1917 TRS has been building better tomorrows for New York City educators.

Once you have five years you are a vested member. TRS is one of the largest pension systems in the United States serving 200000 members. Retirement systems often have provisions for those who start in public service very late in their careers.

UT Austin employees who work at least 20 hours per week for 18 weeks or longer during the September 1 - August 31 fiscal year are required to contribute to a retirement plan. Systems may adopt a retirement age where people can retire even if they have not reached the rule of 80. Accordingly no estimate produced by this calculator shall be in any way binding upon the Retirement System which has sole authority under law to determine your retirement benefits.

Benefit Type The Benefit Calculator allows you to run estimates for service retirement disability retirement and active member death benefits.

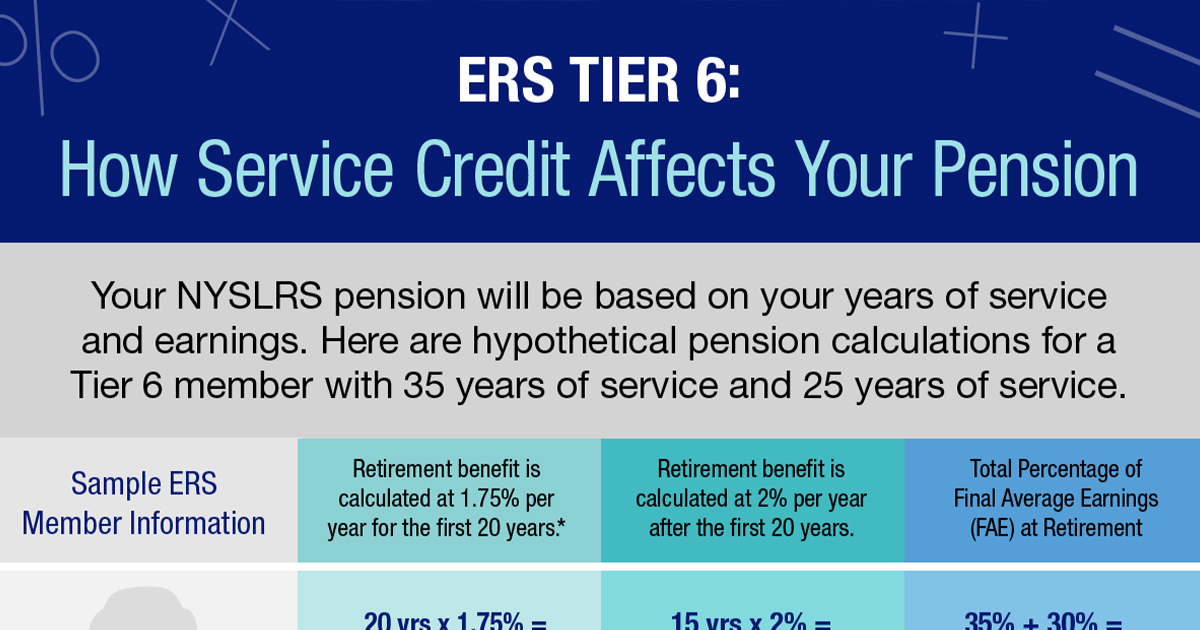

Ers Tier 6 Benefits A Closer Look New York Retirement News

When Can I Retire This Formula Will Help You Know Sofi

Are Texas Teacher Retirement Benefits Adequate Bellwether Education Partners

Teacher Retirement Retirement Retirement Cakes Retirement Cake Sayings Teacher Retirement

![]()

The Best U S States For New Teacher Retirement Benefits

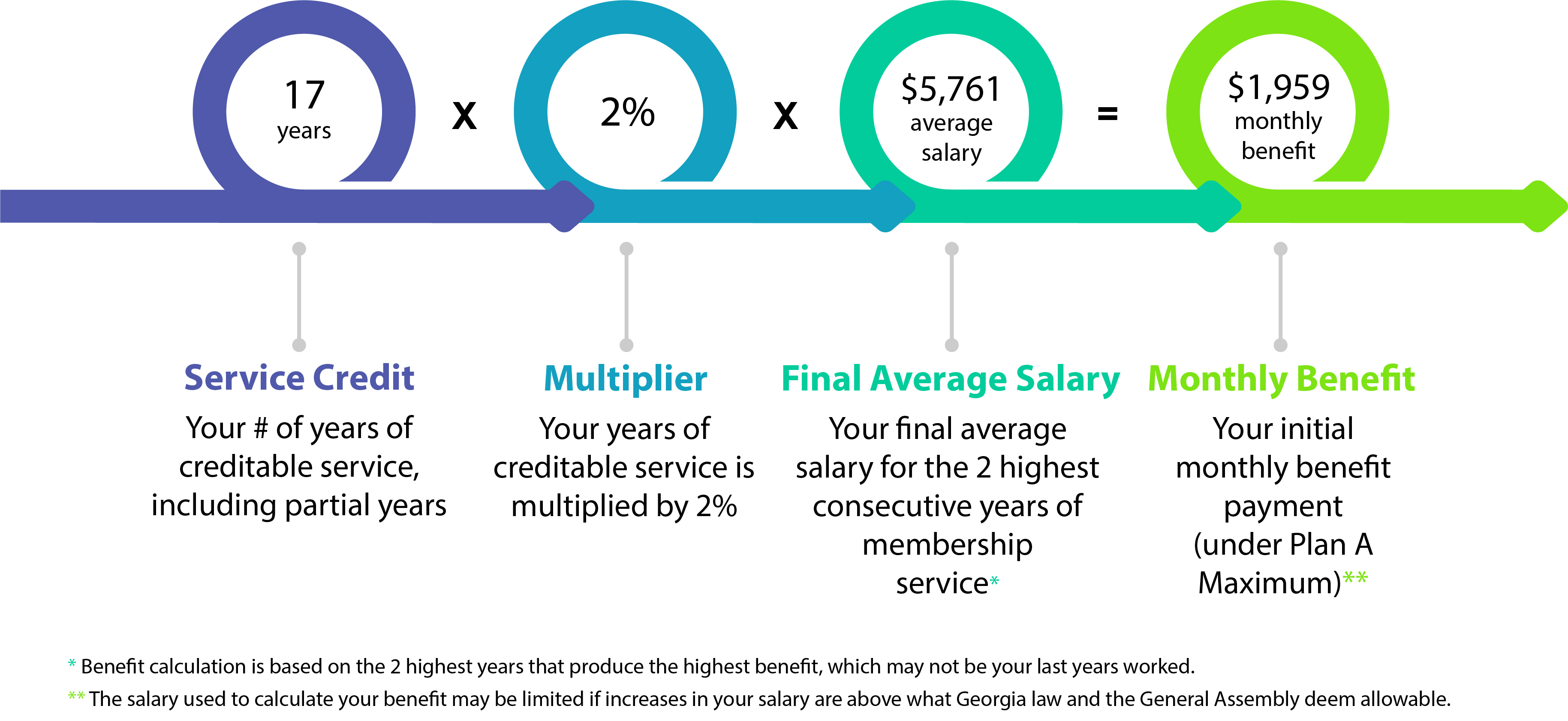

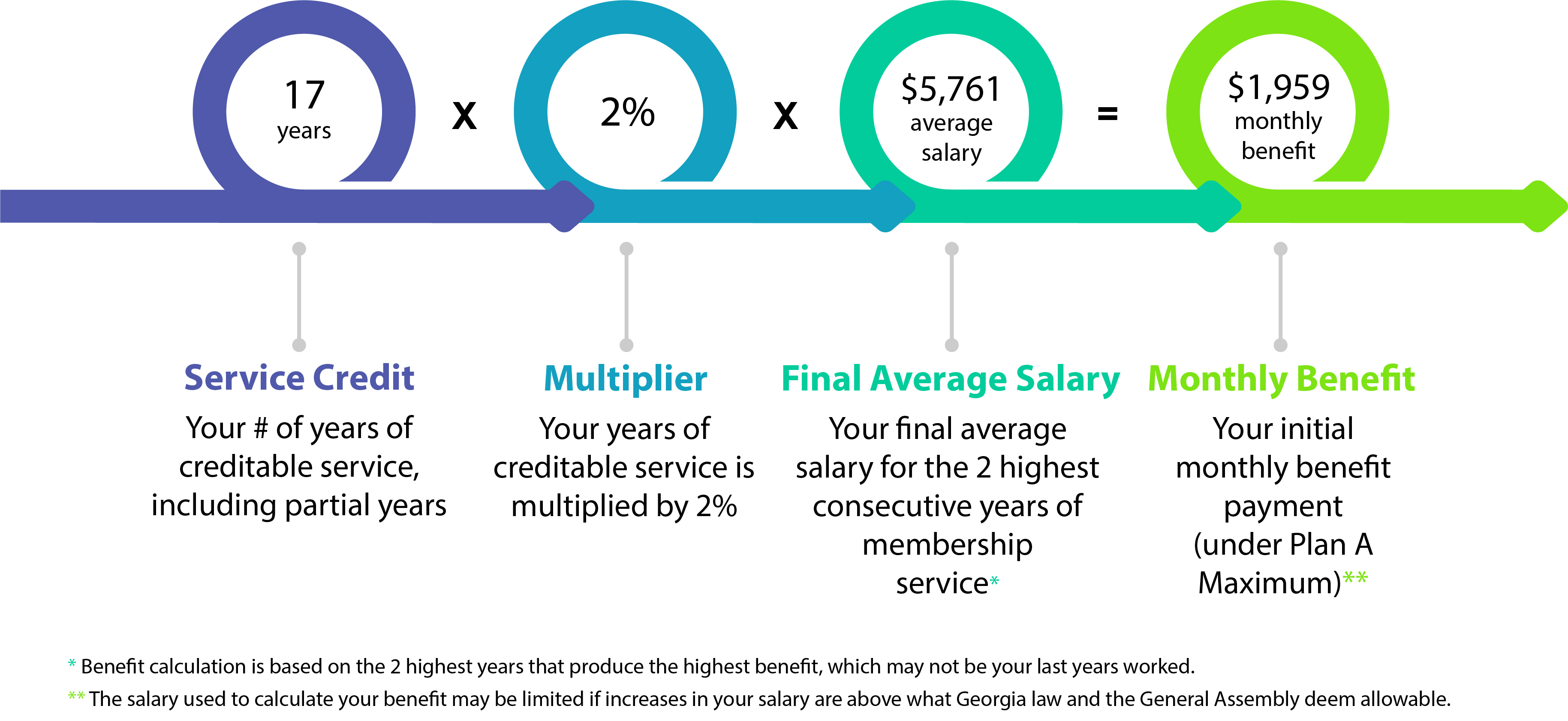

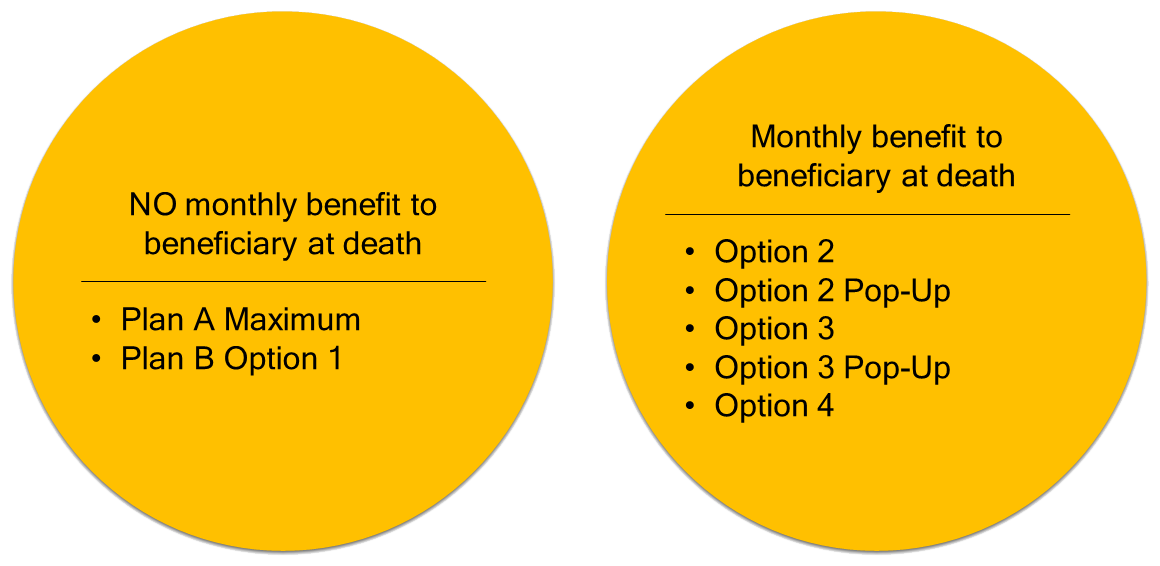

Teachers Retirement System Of Georgia Trsga

Teachers Retirement System Of Georgia Trsga

Trs Texas On Twitter Need Additional Retirement Estimates Visit The Mytrs Retirement Calculator To Instantly Receive Retirement Estimates With Your Information Already On File Https T Co Uipqenwnxe Https T Co R7p91olqq4 Twitter

Teachers Retirement System Of Georgia Trsga

Trs Contributions And Benefit Formula Quick Explanation Youtube

Ny Teacher Pension Calculations Made Simple The Legend Group

Mabent33 Posted To Instagram Teacher Retirement System Of Texas Trs Trs Texas Gov Trs Teachersofinstagram Texastea Teacher Retirement Teacher Teachers

Retirement Security Challenge Week 4 Department Of Retirement Systems Member Member

Teacher Retirement Retirement Teacher Cakes Retirement Cakes School Cake

Welcome To Mytrs

Steps To Retirement Youtube

Teacher Retirement System Of Texas Facebook